Part - 2 : "What are various types of Mutual Funds?" by FinVise India

www.finviseindia.com (Sources : AMFI website)

Various types of Mutual Funds exist to cater to different needs of different people. Largely, they are of three types.

- Equity or Growth Funds

- These invest predominantly in equities i.e. shares of companies

- The primary objective is wealth creation or capital appreciation.

- They have the potential to generate higher return and are best for long term investments.

- Examples would be

- “Large Cap” funds which invest predominantly in companies that run large established business

- “Mid Cap” funds which invest in mid-sized companies.

- “Small Cap” funds that invest in small sized companies

- “Multi Cap” funds that invest in a mix of large, mid and small sized companies.

- “Sector” funds that invest in companies that are related to one type of business. For e.g. Technology funds that invest only in technology companies

- “Thematic” funds that invest in a common theme. For e.g. Infrastructure funds that invest in companies that will benefit from the growth in the infrastructure segment

- Tax-Saving Funds

- Income or Bond or Fixed Income Funds

- These invest in Fixed Income Securities, like Government Securities or Bonds, Commercial Papers and Debentures, Bank Certificates of Deposits and Money Market instruments like Treasury Bills, Commercial Paper, etc.

- These are relatively safer investments and are suitable for Income Generation.

- Examples would be Liquid, Short Term, Floating Rate, Corporate Debt, Dynamic Bond, Gilt Funds, etc.

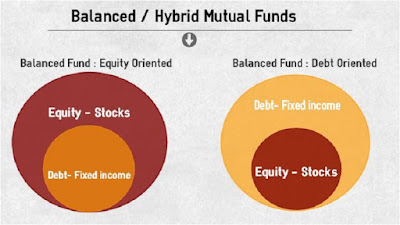

- Hybrid Funds

- These invest in both Equities and Fixed Income, thus offering the best of both, Growth Potential as well as Income Generation.

- Examples would be Aggressive Balanced Funds, Conservative Balanced Funds, Pension Plans, Child Plans and Monthly Income Plans, etc.

Watch the video below to understand the types of mutual funds:

For more details on Mutual Funds, Financial Planning & Personal Finance contact us at :

Phone No. 9582250638

Email id : contact@finviseindia.com

Email id : contact@finviseindia.com

Visit our website :www.finviseindia.com

Comments

Post a Comment